Common contributions

Our people welcome almost all autos, trucks, vans, fleet vehicles, trailers, boats, motorcycles, and Mobile homes, subject to approval. We have customer service reps at the ready to respond to any specific issue you could possibly have such as: "what you can certainly donate?" and even "what status of cars are generally allowed?" Please call us toll free at: (888) 228-1050

What records are documentation is required?

In almost all situations In many cases we will definitely want to have the title to the car, but any state has its particular conditions. Even on the occasion that you don't have title paperwork, get in touch with us anyway; various other options might be put together in most cases in many cases. You can contact us by phoning us toll free at: (888) 228-1050

We value your motor vehicle donation, and we would like to help make that conceivable for you. If you have other issues, you might explore our vehicle donation Frequently Asked Question. Our representatives are waiting on the telephone, ready to serve to help you assess any documents you have to have to donate your automobile.

Will I have the ability to pick up a tax deduction?

You bet, autos donated to registered not-for-profit organizations are actually tax deductible. Due to the fact that we are a 501( c)( 3) non-profit organization, your auto donation to Driving Successful Lives is completely tax deductible. After we collect your vehicle donation, we will mail you a receipt that lists your tax deduction amount.

In general, if the vehicle you give realizes less than $five hundred bucks, you can declare the fair market value of your automobile up to $500. If your donated motor vehicle fetches greater than $500, you are going charity car donation to be able to claim the exact price for which your auto sold. Learn more about how the IRS allows you to claim a tax deduction for your car donation on our IRS Tax Information page.

Your motor vehicle donation to an IRS accredited 501( c)( 3) charitable organization is still tax deductible and is going to come under a single one of these particular classifications:

1. For motor vehicles sold for under $500, you have the ability to claim the reasonable market value as much as $500.00 with no extra documentation. The first tax receipt will be transmitted immediately after car has been validated picked up.

2. In case the complete income from the sale of your donated auto go above $500.00, your write-off will likely be set check here to the verified sale price. You will also be asked by the donee organization to provide your Social Security for the purposes of completing its IRS Form 1098-C form.

Our people will definitely supply you with a stub declaring the final selling price of your automobile in a matter of 30 days of its sale.

Will you provide free pick-up?

Certainly, we definitely will grab the car or truck operating or otherwise free of charge, from a locale that is agreeable for you. If you complete our online donation form our staff will call you the exact same or succeeding business day click here to line up your vehicle pick-up. If you make your car donation by phoning us click here at: PHONE. We will certainly plan for your pick-up at that time.

Who benefits?

Our auto donation plan helps local area charities that serve to help children and families that need food & shelter. Your vehicle donation really helps make dreams come true in a number of donate a car ways-- including holiday season gifts.

We similarly provide financing to establishments that assist Veterans.

Your auto donation aids disabled US veterans simply by raising capital to produce finances for numerous programs to serve to care for their needs.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Jennifer Love Hewitt Then & Now!

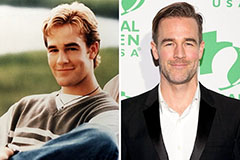

Jennifer Love Hewitt Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!